Financial scams are more prevalent than ever, so here are a few Greenlight tips to keep you safe.

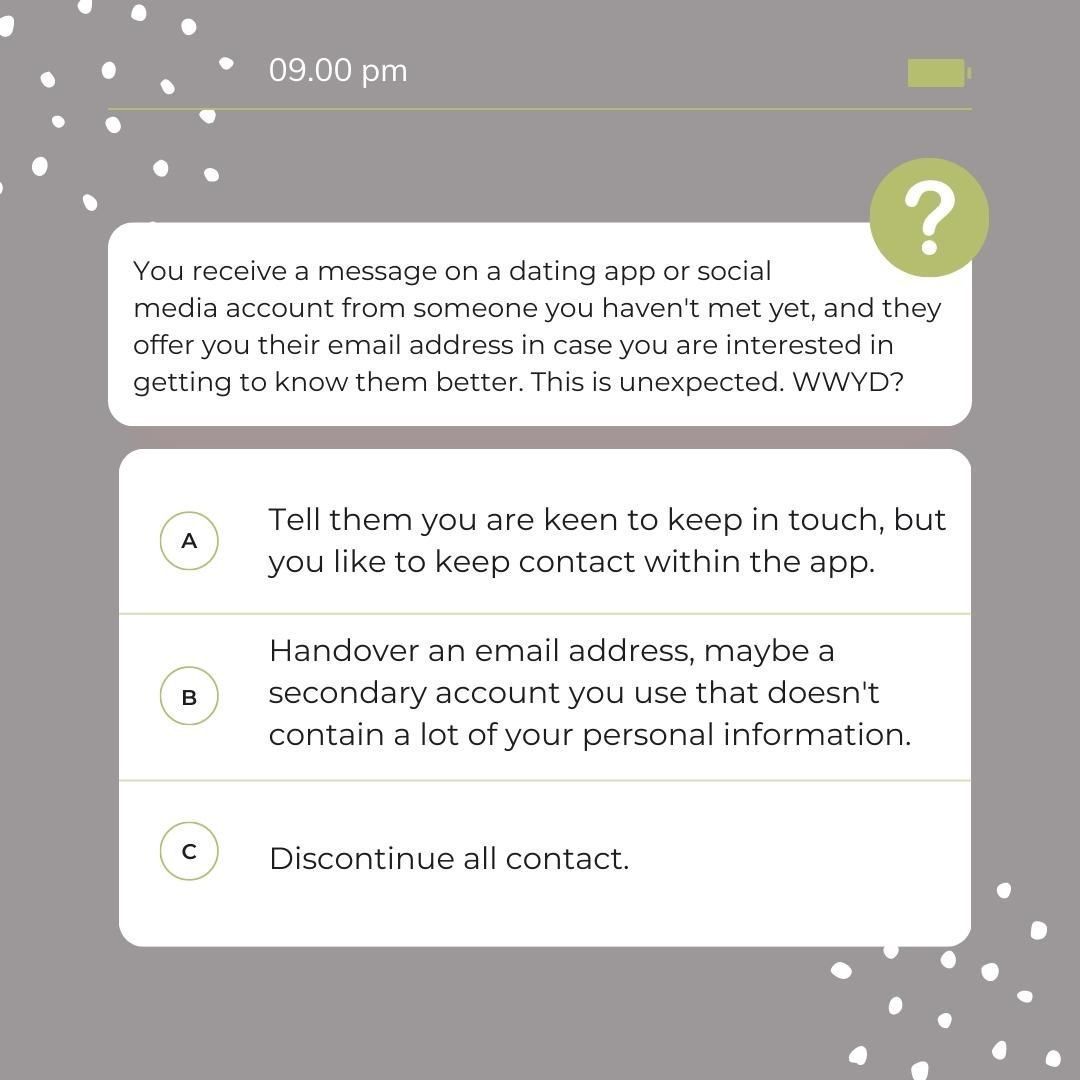

What did you think was the best action to take? Did you think answers A & C sounded like the safest moving forward?

Excellent, that is very scamsavvy of you!

Did you know that:

💓A very common tactic of scammers is to get you off the app they meet you on, and on to a more private means of communication using email, Skype, Whatsapp etc... This is because they know that their time on a dating site is limited. Once a dating profile gets reported and is assumed to be used as part of a fraud, dating websites typically do a respectable job of deleting it.

💓 Singletons looking for love between Xmas and Valentine's Day are most susceptible to romance fraud, according to the National Fraud Intelligence Bureau in the UK. Here is a link to some info to check your dating profile against and make sure your personal details are safe: https://www.abc.net.au/news/2023-01-05/online-dating-scam-cyber-safety-tips-tinder-hinge-bumble/101677338

💓People over the age of 45, especially women, are the most targeted demographic for romance scammers. By this age, they may own a house or a successful business, or have received an inheritance.

💓 Your friends and family may warn you if they think you are talking to a scammer. Scammers know this, and that’s why they ask you to keep your conversations secret. Many will tell you to not disclose to anyone that you are talking to them. Some people may naturally want to keep the fact they are looking for a new relationship quiet – so they might not be as open as they would normally be. Alarm bells should ring immediately if the person their loved one is talking to online starts asking for money.

#scamsavvy

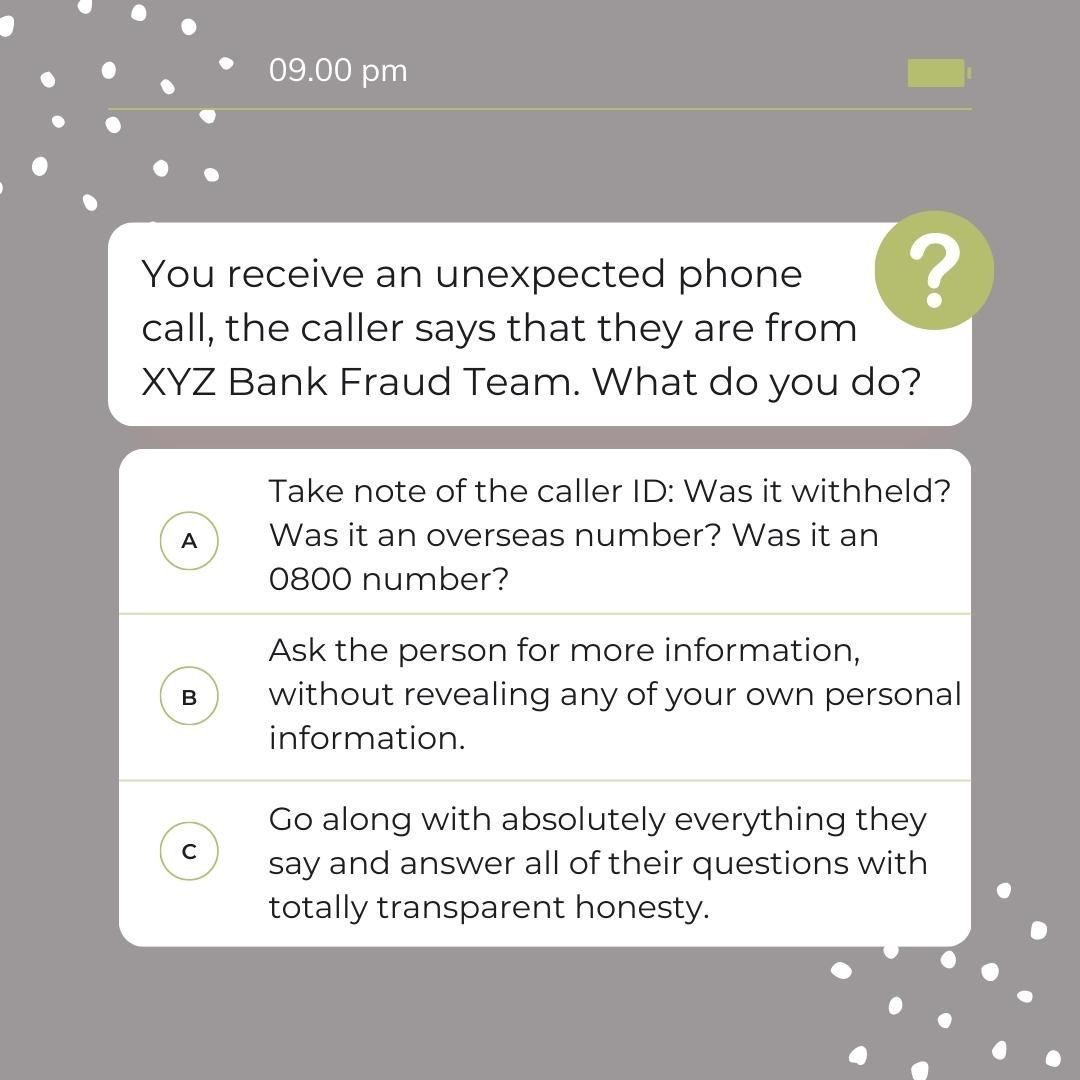

How did you answer? Did you think answers A & B were the safest way to proceed?

Excellent! That is very scamsavvy of you.

Taking note of the caller ID will give you clues as to the true identity of the caller. An overseas phone number that starts with something like +61 might ring alarm bells. Many banks will withhold their caller ID if they are making outbound calls, or perhaps have their 0800 number displayed, or a local phone number. Regardless, if you are asked for any kind of personal information such as an account number, your address, your date of birth, to read out a code texted to your phone, your pin etc... then you need to be extremely certain of the identity of the person of you are speaking to.

Lastly, if you believe that fraud may have been legitimately detected on your account by your bank, then you can always hang up, and call them right back using the phone number that you know to be your bank's. There should be no need to rush into instant action on the spot.

Lana received a cold call from a withheld number over the holiday break informing her of some fraudulent activity on her credit card. Without revealing any information to the caller, she went on to her banking app and checked her statement for the transactions the caller described, only to not find them. Not being convinced of the caller’s legitimacy, she hung up the phone soon after.

Lana then called her bank on the Fraud Help-line listed on the bank’s website. It turns out the caller was from their Fraud Detection Team!!! The transactions were not visible on the banking app because the bank had blocked them from going through. Her credit card was cancelled and a new one couriered out the following day.

Lana says: “The main principle I kept in mind when I received the call was to not accept any help from the individual since I couldn’t be sure of their identity. I got as much information from them as I could and thanked them for their time.” Calling the bank on their Fraud Line was an easy process and the total time taken with them to sort out the solution was under 20 minutes. The result? Total peace of mind. Yay for Fraud detection teams!!!

NB: When having a new credit card sent out, ask if your bank will courier it to you, with a signature required tracked delivery. Lana’s family are one of many who have had credit cards go missing from their letterbox.

#scamsavvy