Top Tips: Studying While Working

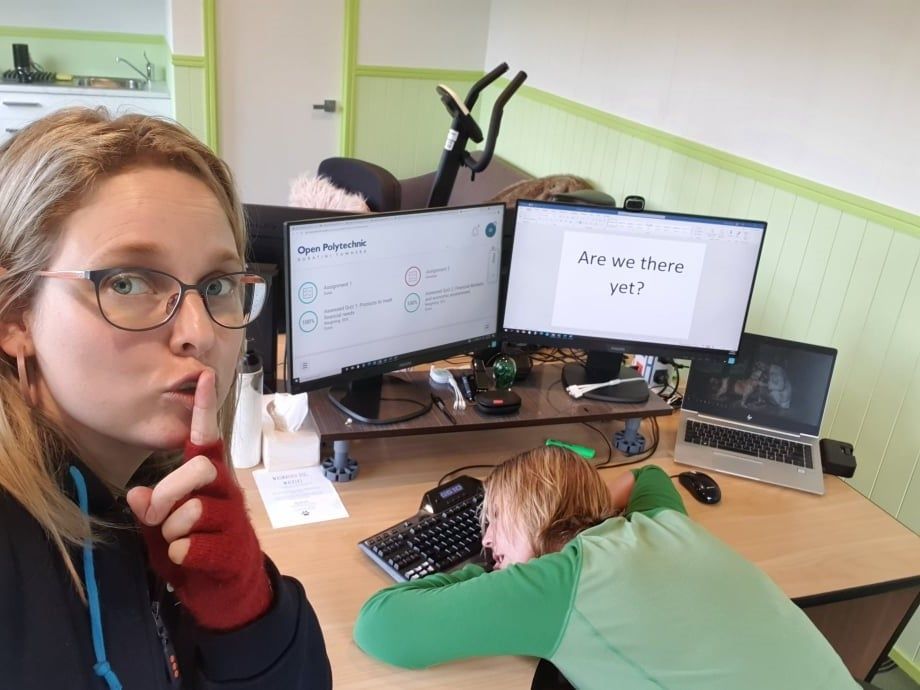

Yep, this picture pretty much summed up 2021 for Vanessa.

She ran a business doing full time hours. Engaged in volunteer work for Scouts NZ. Managed to have a life as well, even completing her first Half Marathon! She also went back to school via the Open Polytechnic to study for her NZ Certificate in Financial Services Level 5!

For Financial Advisers in New Zealand, this qualification will be essential to their practice from March 2023. Vanessa says regulating this industry will be a win for all clients seeking financial services.

She says "I think it will make us better advice providers in our industry. The regulatory framework has made us look at our industry and who is in it, and who shouldn’t be. The work required to become licensed is making it as hard as possible for people who don’t belong here to be here in the Financial Advice industry. We spend so much time in our business, it is difficult to take time to work ON our business. That is what this legislation is making us do. Making sure our business is adequately serving and benefiting it's clients. We hope its quantifying the value of us being around and providing this service."

So how does she manage to fit it all in? Well lockdown helped in some respects, however work continued to flow even during that time.

There are the obvious things, like having the skills to use time wisely. After running a business for 17 years, Vanessa knew what discipline was all about.

When she had to reschedule her study time she would make sure her priorities were right. If not using prescheduled time for studying, then "what am I doing?". "What sort of knock on effect would a reschedule have?" Vanessa also operates by a 3 strikes rule, she never reschedules things more than twice.

"Be realistic too about what your brain can handle" Vanessa says. Have a strategy to deal with brain fade. "I would go for a run or a bike ride. Take a break and eat something healthy, stay hydrated."

Think also about the environment you are working in and make it suitable for the task. Well lit, equipment in working order, ventilated and a comfortable temperature. "I am fortunate enough to have a private home office, away from the house and in some pretty nice surroundings, says Vanessa. "I know many people don't have such luxuries but its worth investing in yourself wherever you can afford to to make sure you are working as comfortably as possible."

The other point Vanessa says is vital for success is asking for help when you need it! Whether it be family for chores, or your lecturer to clarify unclear aspects of your learning. "If you start a paper 2 degrees off course, then you're likely to end up finishing the paper 200 hours later 100 degrees off course! Open Polytechnic have been very supportive of me."

You may also benefit from finding the right study partner. Catching up regularly with someone working on the same paper as you are would have been the one thing Vanessa says would have been nice for her to do, but logistically it was too difficult.

If you are considering an avenue of study you might ask is the study required of you, or are you doing it because you're inspired? Vanessa warns to count the cost first. Not just the cost of your study, but what it will cost you in time. How much discretionary time do you have now, and what currently fills it? If you have no gaps in your discretionary time, then what are you willing to sacrifice? You are unlikely to succeed in your studies if you don't have the time to put the work in. As the saying goes, something has got to give!